Investing

Canadian Financial Services Guaranteed Return

Investing

Canadian Financial Services Guaranteed Return

Alterna’s MarketTracer® Term Deposit - Canadian Financial Services Guaranteed Return is similar to a regular term deposit, but the return is based on the performance of eight major Canadian financial institutions. That means you can participate in the performance of the Canadian financial services market while guaranteeing 100% of your principal investment. On top of it all you receive a guaranteed minimum return paid annually!

For more information or to invest in the Alterna MarketTracer® Term Deposit - Canadian Financial Services Guaranteed Return, contact us.

Product Information

The eight major financial institutions and weightings of the Canadian Financial Services Guaranteed Return are provided below.

|

Alterna’s MarketTracer® Term Deposit - Canadian Financial Services Guaranteed Return at a glance |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

|

Sales Period: |

January 20, 2026 to March 16, 2026 |

||||||||

|

Index |

Equal weighting of eight major Canadian financial institutions |

||||||||

|

Term (non-redeemable) |

3 Years |

||||||||

|

Minimum Investment |

$500 |

||||||||

|

Principal Guaranteed |

Yes |

||||||||

|

Guaranteed Annual Return |

1.00% |

||||||||

|

Guaranteed Cumulative Appreciation |

3.00% |

||||||||

|

Maximum Cumulative Appreciation |

16.00% |

||||||||

|

Market Participation |

100% |

||||||||

|

Plan Eligibility |

RRSP and TFSA |

||||||||

|

Financial Institution |

||

|---|---|---|

|

Bank of Montreal |

12.5% |

|

|

Canadian Imperial Bank of Commerce |

12.5% |

|

|

Intact Financial Corporation |

12.5% |

|

|

Manulife Financial Corporation |

12.5% |

|

|

National Bank of Canada |

12.5% |

|

|

Royal Bank of Canada |

12.5% |

|

|

Sun Life Financial Inc. |

12.5% |

|

|

The Toronto-Dominion Bank |

12.5% |

Alterna’s MarketTracer® Term Deposit - Canadian Financial Services Guaranteed Return is right for you if you:

Benefits

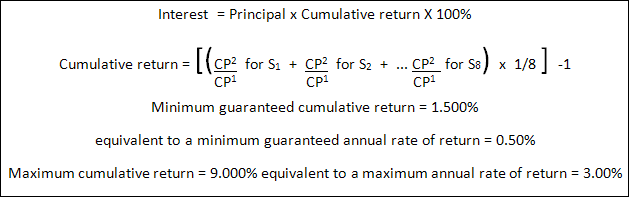

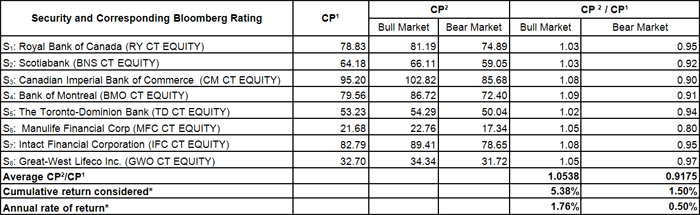

Return Calculation and Example

Example of Return Calculation at Maturity (3-year term)

Definitions:

Principal: The amount of the Initial Deposit

CP²: The average closing price of each security on April xx, 2018, May xx, 2018 and June xx, 2018 (or the following business day if no reading takes place on this security on any of these dates).

CP¹: The price of each security at closing on June xx, 2015 (or the following business day if no reading takes place on this security on this date).

S1 to S8: Each one of the eight (8) securities listed below.

100%: The rate of participation in the growth of the basket of securities.

Alterna refers Alterna Savings and Credit Union Limited (operating as Alterna Savings).

* 3.00% refers to the minimum cumulative return of the 3 Year term (1.00% guaranteed annual return). 16.00% refers to maximum cumulative return possible on the 3 Year term. Rates are subject to change without notice. See in branch for details.

At Alterna Savings, eligible deposits in registered accounts have unlimited coverage through the Financial Services Regulatory Authority (FSRA). Eligible deposits (not in registered accounts) are insured up to $250,000 through the Financial Services Regulatory Authority (FSRA).

Your financial well-being comes first

Welcome to a better way to bank. Our knowledgeable team puts your financial well-being first with good, caring and transparent advice while offering all the products and services you need.

Stay in touch. Be the first to know about news, promotions and announcements. Sign up now!